MoneyHash has today announced its pre-series A funding of $5.2 million led by Flourish Ventures.

Institutional investors: Saudi’s Vision Ventures, Arab Bank’s Xelerate, and Emurgo Kepple Ventures participated in the pre-series A. Jason Gardner, former CEO and founder of Marqeta, a 15-year-old card-issuing platform also participated. Existing investors: COTU, RZM Investment, and GitHub founder, Tom Preston-Werner followed on.

Moving money or making payments in multiple countries presents unique complexities. Each country has its regulations, payment rails, user-favoured methods, and payment providers offering local payment services. These cross-market differences slow time-to-market, and lead to drop-offs, and high failure rates.

“In emerging markets, payment infrastructure remains significantly underdeveloped, with failure rates three times the global average and fraud rates and cart abandonment over 20% higher than developed markets,” says Nader Abdelrazik, co-founder and CEO of MoneyHash.

MoneyHash launched in 2021 to solve these problems by orchestrating each payment transaction to ensure high success and conversion rate. The company, founded by two Egyptian technologists focuses on the Middle East and Africa (MEA) region. Maram Alikaj, MoneyHash COO said, “We’ve built our product with a deep understanding of emerging markets’ unique challenges. Rather than letting merchants struggle with fragmented solutions, we provide a unified suite that elevates all payment performance metrics.”

See also: Tunisian paytech, Konnect Network raises $1.5 Million

Investors have responded favourably. It emerged from beta in February 2022 with a $3 million pre-seed. In February 2024, it raised a $4.5 million seed. Thus, the company has secured a total of $12.7 million from investors.

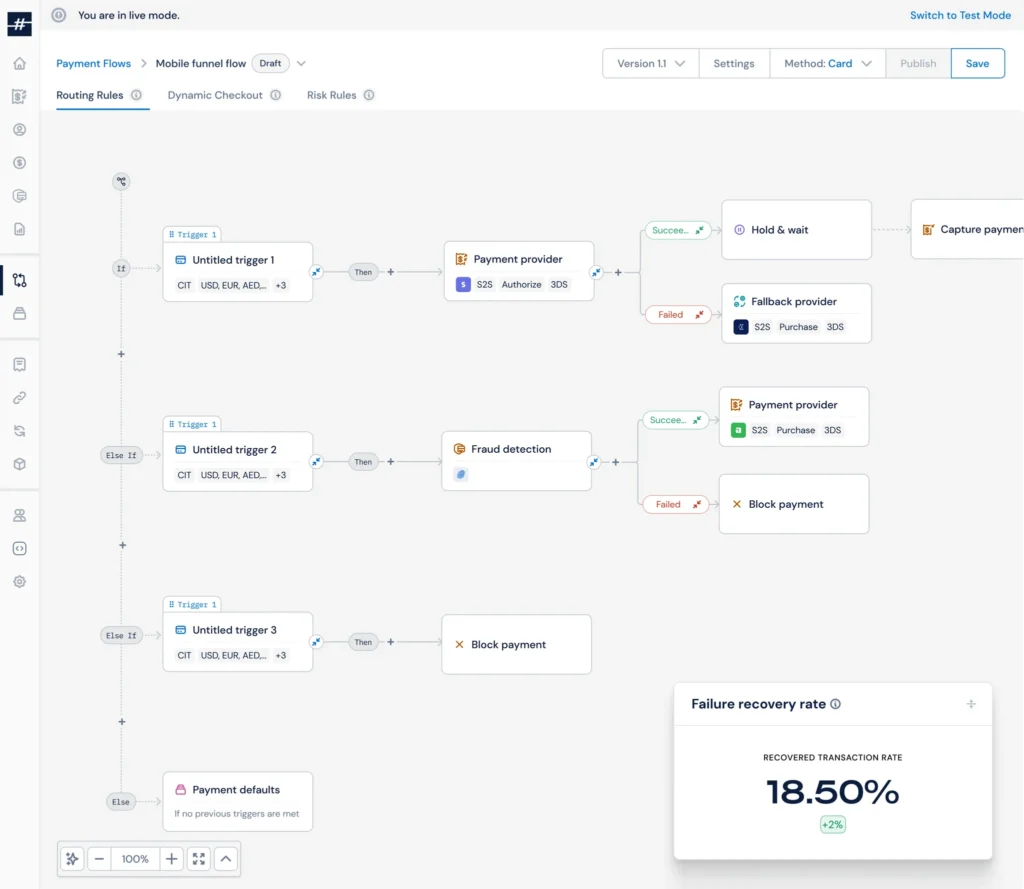

The company offers a pay-in and pay-out API, a customisable checkout widget and transaction routing services to different providers. “With over 300 pre-integrated APIs of payment service providers and methods across 100+ markets, we’re not just solving today’s challenges—we’re future-proofing payment operations for our merchants,” adds Alikaj.

MoneyHash’s customers include unicorns, Tamara—a Saudi fintech, Kitopi—a cloud kitchen and Brands for Less, a global e-commerce player.

“The company’s strategic focus on large enterprise clients has yielded remarkable results, with this segment now constituting over 35% of MoneyHash’s client portfolio—representing a threefold expansion in 2024. This strategic positioning has catalyzed exceptional growth, resulting in a 4x increase in processing volume throughout 2024,” reads a statement shared with Condia.

Ameya Upadhyay, Venture Partner at Flourish Ventures, says, “MoneyHash has built a must-have product for enterprises that delivers better payment performance and higher margins from day one. As early-stage investors with a large EM-focused payment portfolio, we have first-hand experience of the massive scale of the opportunity. The team’s deep payment experience and obsessive customer focus positions them to emerge as a leader across Emerging Markets, starting with MEA. We are privileged to be part of the journey.”

As part of Flourish Ventures’ investment, Upadhyay will join the MoneyHash Board of Directors.

See also: Ivorian fintech, HUB2 secures $8.5M Series A to become the ‘Stripe of Francophone Africa’

MoneyHash CEO Abdelrazik says, “In our early years, we strategically focused on partnering with strong regional investors to accelerate our market penetration. Now, with Flourish Ventures joining us, we’re establishing a solid foundation for global expansion. Having such a fintech well-seasoned, globally recognized fund as our partner is particularly crucial for our next phase of growth.”

The company will use the capital to deepen its MEA penetration while seeking out additional expansion markets.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore