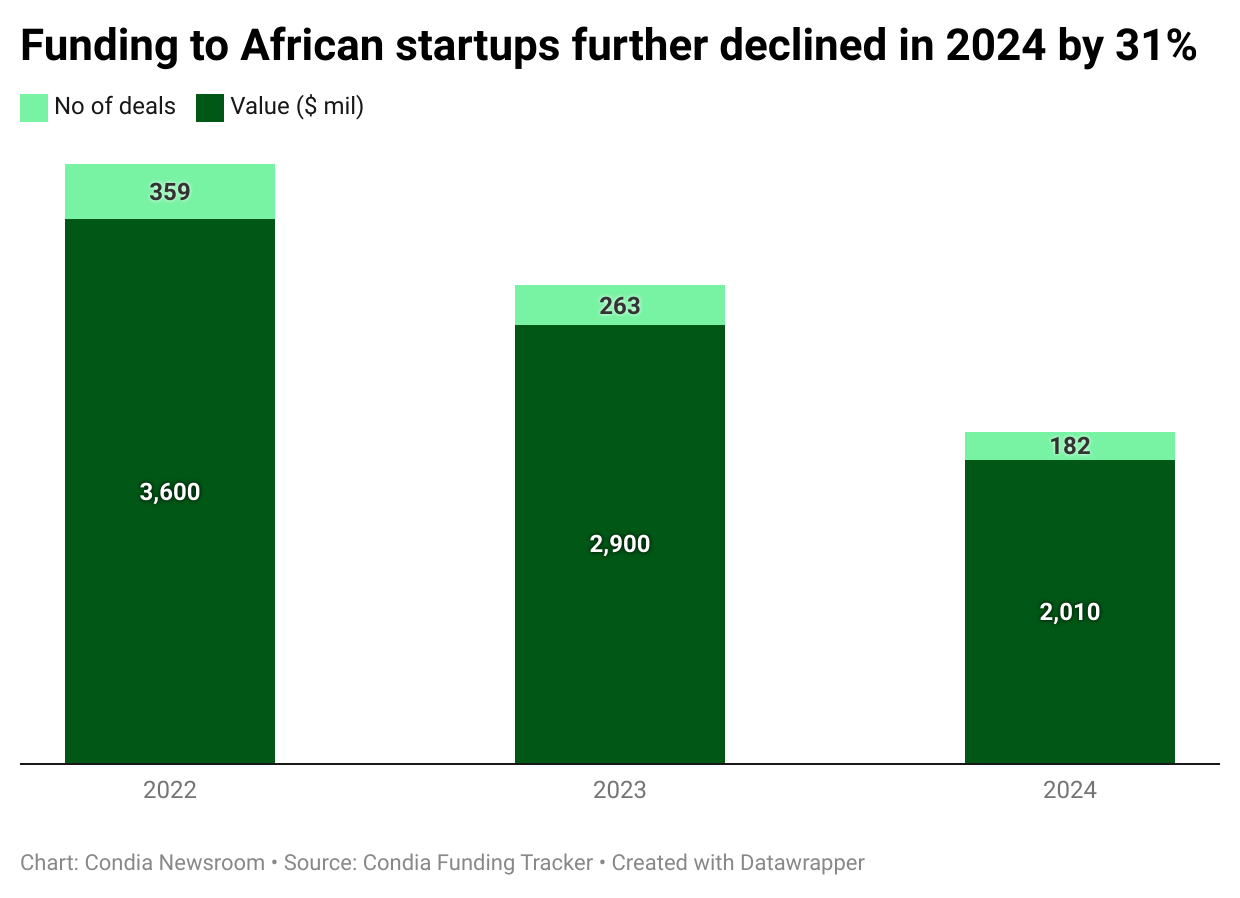

In 2024, African startups raised $2.01 billion across 182 deals, data from Condia’s Funding Tracker reveals. This reflects a 31% drop in funding amount and deal volume from $2.9 billion in 263 deals in 2023.

Over the last two years, there has been a trend of the top five startups raking in an outsized proportion of the VC funding to the continent. The share of funding to the top five startups was 37%, 40% and now, 45% in 2022, 2023, and 2024, respectively. Indeed, we observe that following the market correction, funding concentrated towards growth-stage performers versus early-stage me-toos.

Debt financing declined

In 2023, debt funding played a significant role in uplifting the amount that went to African startups. Unlike the prior year (2022) where it was only 26% of total funding, in 2023 it increased to 35%. However, this year, instead of tending upwards, it remained flat.

Thus, African startups closed fewer debt deals in 2024 as debt funding was down by 68% to $712.9 million. Meanwhile, $1.12 billion was invested in African startups via equity rounds. There was a small set of mixed deals (equity and debt) that amounted to $168.1 million.

Twice as many deals were announced in H2 over H1

Funding activity in 2024 was heavily weighted toward the second half (H2) of the year. H2 accounted for $1.3 billion, about double the $661 million raised in H1.

July was the standout month, announcing $478 million—a sum higher than what the most-funded country raised in the whole year. Thanks to Kenya and Egypt’s d.light and MNT-Halan’s mega raises of $176 million and $157.5 million, respectively.

December followed July, as it saw some last-minute end-of-year announcements totalling $294.6 million. South Africa’s Tyme’s Series D raise of $250 million carried the month.

Kenya tops the African funding charts

Kenya dominated the geographical funding landscape in 2024, securing $418.9 million—20.8% of the total. This put Kenya ahead of South Africa ($352.78 million), Nigeria ($331.52 million), and Egypt ($290.29 million).

The singular debt raise of $225 million from Ugandan telco, UTel put the country in the fifth position by funding amount, despite having only three deals announced.

Fintech is still king in Africa

In 2023, fintechs raised half of all the funding to African startups. Last year, its dominance was only slightly challenged as it dropped to 43.9% of total funding.

In the weak first half of the year, Mobility was leading but will later settle at $300.42 million (14.9%) while fintech sped past to close the year with $882.43 million.

CleanTech in Africa is still a big focus area for investors. It secured $294.8 million (14.6%) in 21 deals.

The rise of Mobility and CleanTech funding underscores a growing focus on addressing urbanisation and sustainability challenges.

Emerging sectors like AI ($10.6 million) and Edtech ($22.35 million) saw modest funding, signalling future growth potential.

2024 was a year of adapting

Despite a global slowdown in venture capital, Africa’s startup ecosystem proved its resilience in 2024. While funding levels and deal volumes dipped compared to 2023, a strong second half marked a turning point, hinting at stabilisation and renewed investor confidence for the new year.

Investor interest is expanding beyond fintech, with sectors like Cleantech and mobility stepping into the spotlight. This shift reflects a growing awareness of Africa’s potential to lead in sustainability and innovative solutions for its unique challenges.

With emerging sectors gaining momentum, innovation continues to thrive, and investors' confidence gradually returning, there’s cautious optimism for the road ahead.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore