Sequel to its recent name change, online savings and investment platform—PiggyVest—has announced its investment feature—Investify.

Investify is PiggyVest’s way of helping her near 250,000 subscribers grow their wealth.

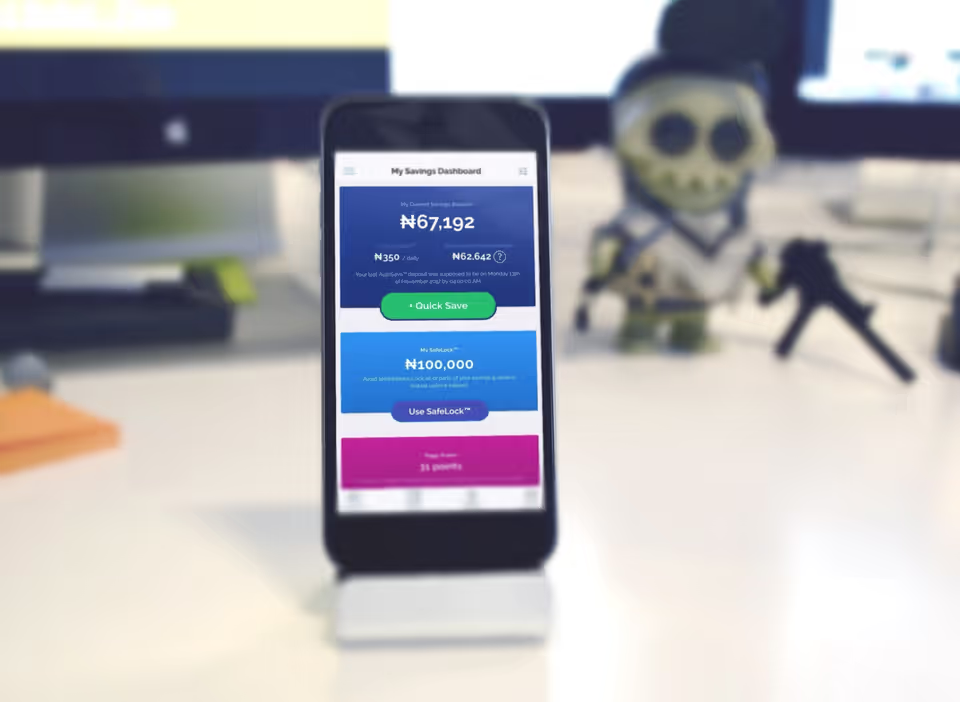

Founded in 2016, PiggyVest launched as a savings product—Piggybank.ng, subsequently, they added more savings solutions to their platform like Safelock, Target Savings, and PiggyFlex. Those initiatives were targeted at increasing the pool of funds at their disposal by getting customers to increase the amount of money they saved with Piggybank and for longer periods.

When it comes to financial services, the more money you can amass, the better rates you get on investment vehicles. If we were to split the markets where these money are sold into two, it would be just the money market (mm) and capital market (cm), where mm is for short-term durations and cm is for longer-term investments.

So, Piggybank as an aggregator would typically take all these money and put them into investment vehicles (AKA securities) like treasury bills, commercial papers, sovereign bonds, state bonds, corporate bonds, Eurobonds and equities. Others are mutual funds, real estate and venture capital. Investments can be done primarily (directly with the vehicle) or secondarily (through a middleman) and it can alternate based on the distance between the investor and the managed asset. Secondary investments are brokered by accredited securities and asset management firms (list) like Investment One and ARM.

Secondary investments are a thing because of the need for humongous capital at once, which one person can not easily provide. In the case of the Nigerian Stock Exchange, a stock broker is required because of the expertise needed to trade. In summary, going through a broker helps meter the entry points to the exchange and prevents a potential mess from happening.

P.S.A: The average good investment vehicle will give you a return rate higher than the nation’s inflation rate, to protect the value of your money.

So, if for instance you invest in mutual funds via a Cordros Securities Limited then you are making a secondary investment.

However, digital innovation has introduced more lucrative but high-risk investments usually cause they can be done primarily, so no need to split fees between too many people (middlemen). A rule of thumb in investment is that “No risk, no return. The higher the risks, the higher the return” and vice-versa. One of such digital innovations is the rise of agricultural players leverage a crowdfunded model to funding farms. Two popular examples in Nigeria are Thrive Agric and Farmcrowdy.

Thrive agric offers a direct investment platform for people to fund farms and get returns as high as 15% in just 6 months, dwarfing what other conventional investment vehicles like those listed above offer—15% in 12-months.

However, the funding amount required by Thrive Agric is quite steep, considering it has to be paid at once. According to a report we once filed, a farm could sometimes cose ₦85,000 ($236). So, usually, it excluded individuals with lower disposable income. Particularly in Nigeria, where that farm amount could be an employee’s entire monthly take-home. So, from where will such a person be able to “dispose income” into vehicles that could create future wealth for them.

So, this is where PiggyVest comes in to make investment opportunities directly available to its subscribers. Of course it is not altruistic, as they are a business.

Investify is necessary to PiggyVest for two reasons.

One, lock-in customers. For the few customers able to invest, they are met with a plethora of options—investment in similar substitute products like Cowrywise or another investment product in a different vertical like AgriTech. Eitherway, Piggybank faced stiff competition in that regard.

That move is both smart and perhaps, timely.

Because, previously, when I as an individual wants to stow money away for future returns, I had to choose between direct agritech investments which can be bulky or fixed deposits in savings-fintech which could starve either of funds.

— Benjamin (@DadaBen_) April 27, 2019

But by adding a channel for investments directly from their platform, they’ve changed the game—and I foresee that they’ll reap the first-mover’s advantage in this regard before others catch-up. Now, potential customers (that is, those willing and able to invest) have one more reason to choose PiggyVest over the competition.

It’s happening, as on more than one occasion people have indicated interest in opening a PiggyVest account due to this feature.

thats it, im getting piggy bank

— Sani Yusuf (@saniyusuf) April 28, 2019

As a fringe benefit, it gives their existing users a reason to upgrade their app, which is a win for Piggybank because they can bundle in security patches and improved user experience to make their app even more compelling.

Two, financial rewards. If you’ve read everything I’ve written so far, you’d get the idea that with more money comes a command for greater interest rates, largely cause of leverage you now have.

So, a PiggyVest would guarantee funds to a ThriveAgric, negotiate (a decent) interest rate and pass down some of it to their PiggyVest users, while pocketing the spread—akin to a bank’s modus operandi.

Investify for a PiggyVest subscriber

For a subscriber, the way Investify would work is that it enables them invest in securities with a lower initial outlay required.

In the case of Thrive Agric, a PiggyBank subscriber can now pay as low as ₦10,000 and still reap the 20% return in 9 months. Previously, such customers were locked-out from investing in the likes of Thrive Agric.

PiggyVest users are presented three ways to pay; their core savings, their Piggyflex account or from their bank accounts.

With this, Thrive Agric can boase more users on their platform and would almost never run out of capital to fund their farming operations.

Investify is a win-win for everyone, investment partners like Thrive Agric, their subscribers (future customers) and PiggyVest themselves.

What other ways do you think stakeholders are benefitting from this new PiggyVest feature?

Reach me on Twitter.

Cover Photo: PiggyVest

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore