Kuda Bank has announced that starting from July 15, 2022, its users will be charged a ₦50 stamp duty on deposits of ₦10,000 and above. As expected, many users are alarmed by this, so we decided to do an explainer.

“Kuda” or “Kuda Bank” is a product of not just a technology company, Kuda Technologies Ltd. But also, a regulated financial institution, Kuda Microfinance Bank (MfB). Their MfB licence is what gives them the right to open accounts for customers and hold deposits.

Many banked users in Nigeria are familiar with a stamp duty being charged on eligible receivables or deposits into individual current accounts or corporate accounts (which are still a form of current account).

So, one question is, does Kuda issue current accounts to its users? Well, according to its website footer, the short answer is YES. “Kuda Current Account is provided through Kuda Microfinance Bank (emphasis mine)”

However, that’s not the full story. To open a current account in Nigeria, the account holder needs to provide two references. But Kuda doesn’t ask new users for references, so it not a “pure” current account.

Let’s examine the second bank account type in Nigeria—a Savings account. A major characteristic of this is that deposits in savings accounts earn an interest (no matter how small). Most times that interest never materialises due to some conditions on withdrawal count limit and what not. Nonetheless, Kuda doesn’t give interest on deposits. So, the Kuda account is also not a Savings account.

What then is the account that Kuda issues its users? It’s a hybrid account that is best described as a “Spend” or “spending” account. Users get 25 free bank transfers every month and can move money into a dedicated savings bucket that can then earn interest.

Regardless, of account type, a stamp duty on bank transfer called an Electronic Money Transfer Levy is chargeable. More on this later in the article.

What’s a stamp duty?

Today, in practice, a stamp duty is a tax levied by the Government to generate revenue for its programmes and activities. Historically, stamp duties are imposed on documents required to legally record certain types of transactions. These transactions include the sale or transfer of property, real estate, patents, securities, and copyrights. Before digitalisation, physical revenue stamps were placed on these documents to show that the tax liability on the transaction represented in that document has been paid. Thus, making the document legally effective and tenable in court.

In Nigeria, stamp duties are a crucial source of non-oil tax revenue for the Government. Other sources of non-oil tax revenue include Company Income Tax (CIT), Gas income, Capital Gains Tax. And the FIRS collected more stamp duty tax than on capital gains. In 2021, the total stamp duty collected by the FIRS was ₦33.94 billion ($80.9 million) which represented 1.7% of all non-oil tax collections.

The stamp duty collected in 2021 represents a sharp decline of 71% compared to 2020’s ₦120 billion.

State Inland Revenue Insiders who spoke on condition of anonymity told Benjamindada.com that stamp duty has been an underutilised source of revenue for the Nigerian government. And this time around, the spotlight has been turned to deposit-holding fintechs and payment startups.

How does stamp duty concern electronic funds transfer?

When you transfer money, a receipt is generated by your bank as proof of that transfer. That receipt, albeit electronically generated, is regarded as liable to stamp duties. But the person to pay the stamp duty is not you the sender, but the recipient of such funds.

On June 3, 2021, the Federal Inland Revenue Service (FIRS) released a circular to clarify the provisions of the stamp duties act (SDA). In that circular, they explained that electronically generated receipts are liable for stamp duties. And they admonished Banks and other financial institutions to charge appropriate stamp duties on qualifying transactions. “The stamp duties so charged shall be remitted to the Federal Inland Revenue Service”, reads the circular.

Perhaps, a more formal definition of stamp duty on electronic funds transfer is what they call the Electronic Money Transfer Levy (EMTL). “The Electronic Money Transfer Levy is imposed on electronic receipts or electronic transfer of money deposited in any deposit money bank or financial institution, on any type of account, to be accounted for and expressed to be received by the person to whom the transfer or deposit is made.”

How much is the stamp duty and when does it apply?

According to the FIRS circular, Banks and other financial institutions are to charge a ₦50 levy on:

- all intra-bank deposits and transfers from ₦10,000 and above except where the deposit or transfer occur between two accounts maintained by the same person in the same bank;

- all inter-bank deposits and transfers from N10,000 and above involving accounts owned by the same person in different banks; and

- all inter-bank deposits and transfers from N10,000 and above involving accounts owned by different persons.

- All other electronic receipts issued for deposits received by a financial institution in Nigeria

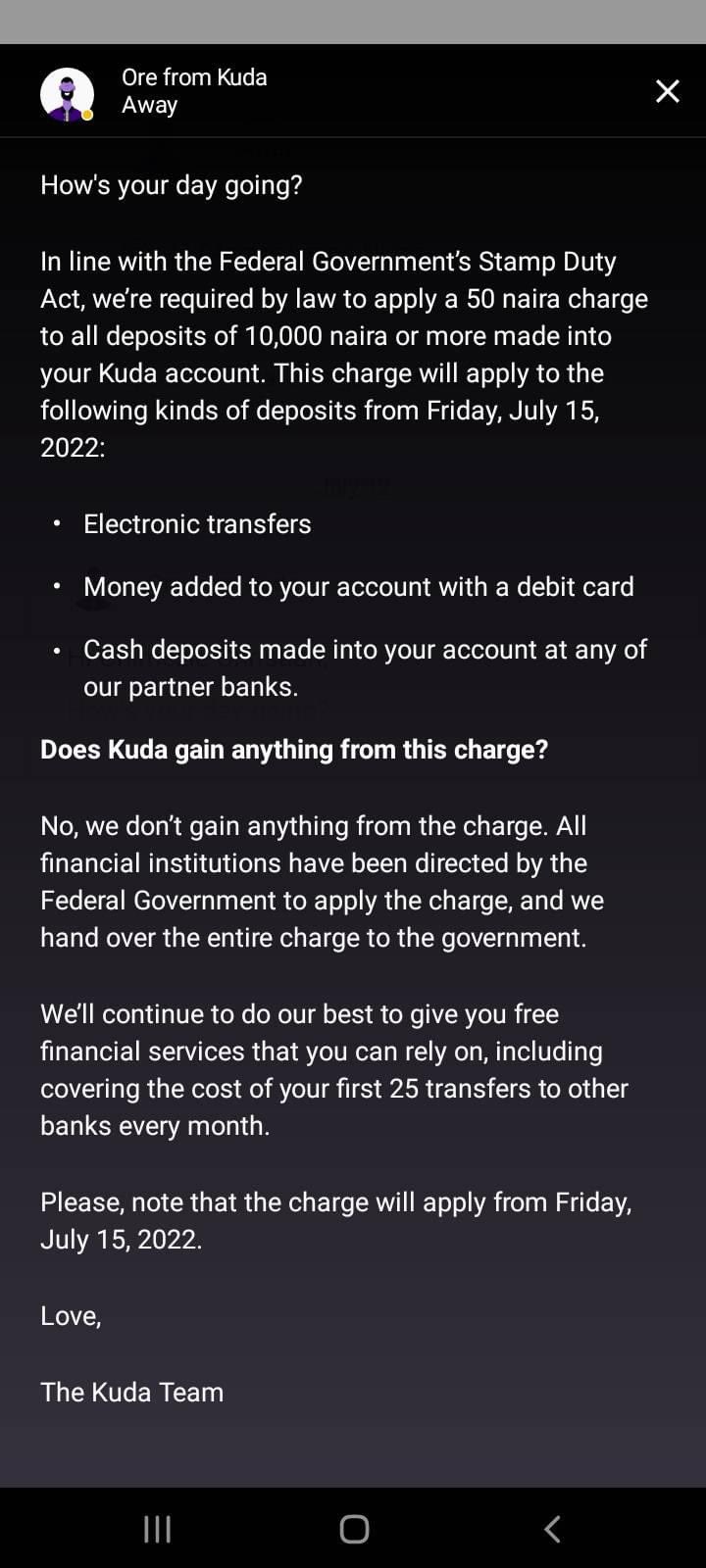

Thus, a Kuda Bank, which can be an originating or beneficiary financial institution needs to only care about its role in receiving funds—cause that’s when the stamp duty applies. Hence, why they told their users that they will charge ₦50 on deposits of ₦10,000 and above. And not transfers.

By charging the mandated ₦50, they do not gain anything from such transactions as they hand over the entire charge to the Federal Government.

Related Article: Is Kuda changing the dial in terms of customer experience?

Is it only Kuda Bank that is complying with the circular?

No. In fact, Kuda is somewhat late.

Other digital banks like ALAT by WEMA have been deducting stamp duties since 2020. V Bank introduced stamp duties since 2021.

Other traditional and digital banks are either already charging stamp duties (without adequate customer notice), or about to implement it. Carbon, a neobank in Nigeria, has notified its users that it will charge stamp duty from Monday, July 18, 2022.

Update on Stamp Duty: @get_carbon has notified its users that from next week Monday, July 18, 2022, they will start charging stamp duty.

This is in line with a mandate from the FIRS, as explained in our article (linked below) pic.twitter.com/c3v2AcSC40

— Benjamindada.com | Premium tech blog (@dadabenblog) July 14, 2022

According to the FIRS, failure to comply with provisions of the SDA may result in any of the following consequences:

- Prosecution for offences under the Act.

- Payment of penalties of various degrees.

- Inability to use the relevant instrument as evidence in court or other judicial or quasi-judicial proceedings.

- and other enforcement actions

Update, July 14, 2022: Article has been updated to reflect Carbon’s stamp duty charge

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore