The Central Bank of Kenya (CBK) has said that African unicorns—Flutterwave and Chipper Cash are not licensed to operate in the country.

“Flutterwave is not licensed to operate as a remittance provider or for that matter as a payment service provider in Kenya. They are not licensed to operate and therefore they shouldn’t be operating. We can also say the same for Chipper Cash,” CBK’s Governor, Patrick Njoroge, revealed during a Monetary Policy Committee (MPC) meeting on Thursday.

On Friday (July 29, 2022), the Central Bank of Kenya through the Deputy Director of Bank Supervision, Matu Mugo instructed CEOs of financial institutions in Kenya to “cease and desist from dealing with Flutterwave and Chipper Cash”.

How did Flutterwave and Chipper Cash expand to Kenya?

Flutterwave expanded into Kenya in 2016 through a partnership with Kenya’s KCB Bank —is a financial services provider headquartered in Nairobi, Kenya. It is licensed as a commercial bank, by the CBK.

“We have been in constant engagement with the Central Bank of Kenya to ensure that we provide all the requirements and we look forward to receiving our license,” Flutterwave said. In 2019, the fintech company reportedly submitted applications for a Payment Service Provider license.

Kenya was Flutterwave’s first East African market. Recently, the company gained approval from the Bank of Tanzania (BoT) to launch its payment service in the Republic of Tanzania—its latest East African market.

Flutterwave has previously described the East Africa region as a “significant market”. The fintech company leverages partnerships with Airtel Money, MTN’s MoMo, and Amole to power its operations and infrastructure in the region.

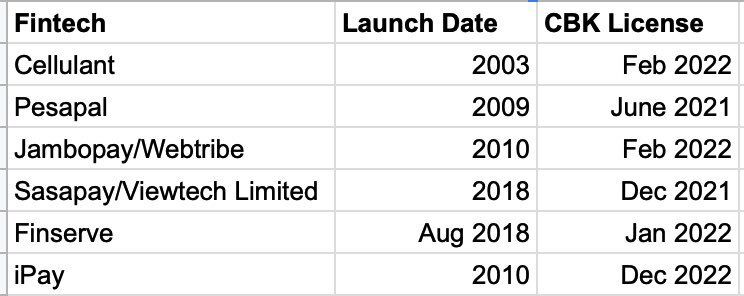

Like Flutterwave, other fintech companies expand their operations into the country through partnerships with banks and mobile network operators licensed by the Central Bank of Kenya due to the stringent policies. “The truth about fintechs and how long it takes them to operate before they get licenses in Kenya. I tried to invest in iPay in 2010 so I am very familiar with this. So, let’s kill the narrative of Nigerian fintechs “breaking the laws”, those licenses are never easy to get,” Victor Asemota, an African investor tweeted.

In January, Leon Kiptum, the Country Director for Chipper Cash in Kenya told HapaKenya that “Chipper Cash was not well guided until someone with experience joined the business. Initially, we were operating in partnerships with companies that have licenses. The laws have since changed, and we had a window to apply for the required licenses for operations and comply with the new regulations.”

According to Kiptum, the fintech company needs two licenses (to operate in Kenya)—a Payments Service Provider (PSP) license which allows you to have a wallet and an International Money Transfer Operator (IMTO) license. He revealed that Chipper Cash has applied for the IMTO license and is awaiting approval.

Both Flutterwave and Chipper Cash are experiencing a snub from CBK, which further underscores data that was shared by Asemota. According to the data, fintech companies that have operated in Kenya for over 10 years got licensed by the CBK within the past two years.

How to get a PSP license in Kenya

For the CBK to issue a PSP license, companies are required to go through four steps which involve a preliminary engagement that has to do with studying the National Payment System (NPS) Act and Regulations and interacting with the CBK, this typically takes three weeks.

After that, PSPs are required to propose and book at least three business names with the Registrar of Companies. “The name, if approved, will be valid for 12 months from the date approval is granted by the CBK within which the applicant should have received authorisation to carry out PSP services,” a CBK document reads.

The third step is the application for an authorisation certificate. After the confirmation of approval for the proposed company and product name, will pay a non-refundable application fee of Kshs. 5,000 (~$42). For foreign companies, a signed declaration by the board of directors to adhere to the NPS Act and Regulations is required among other documents.

When the PSP has successfully completed stages two and three, the Central Bank of Kenya if satisfied with the application will issue a letter of intent requiring the PSP to pay an authorisation fee of Kshs. 100,000.00. (~$841), this then is followed by the issuance of an Authorisation Certificate permitting the applicant to commence the business of payment services in the country.

The licensing processes for money remittance providers (MRPs) are almost the same as the above, including the fee.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore