In 2021, about 1.6 million reports, constituting 42% of all Bank Secrecy Act (BSA) filings in the US, were focused on concerns related to identity fraud, as disclosed in a report by the US Financial Crimes Enforcement Network (FinCEN).

According to Andrea Gacki, FinCEN Director, “Robust customer identity processes are foundational to the security of the U.S. financial system and critical to the effectiveness of financial institutions’ programs to combat money laundering and counter the financing of terrorism. Financial institutions are encouraged to work across their internal departments to address these schemes.”

The analysis revealed that a majority of attackers, comprising 69% of identity-related BSA reports (~1.7 million filings), engaged in impersonation to defraud victims. Additionally, 18% of identity-related BSA reports (around 446,000 filings) detailed attackers utilizing compromised credentials for unauthorized access to legitimate customer accounts, while 13% (about 323,000 filings) reported attackers exploiting insufficient verification processes.

Depository institutions were the leading filers of identity-related BSA reports, accounting for 54% (about 1.3 million filings) and reporting $201 billion in suspicious activity. Money services businesses (MSBs) constituted the second-largest category of filers, contributing 21% of identity-related BSA reports.

Among the reported issues, fraud emerged as the most prevalent, with approximately 1.2 million instances, followed by false records (~423,000), identity theft (about 222,000), third-party money laundering (approximately 154,000), and circumventing standards (~ 110,000).

Identity-related issues had different effects, as attackers mostly pretended to be someone else, followed by finding ways to get into accounts and avoid being noticed. Surprisingly, when attackers got into accounts, it caused a lot more financial damage compared to pretending to be someone else or avoiding detection.

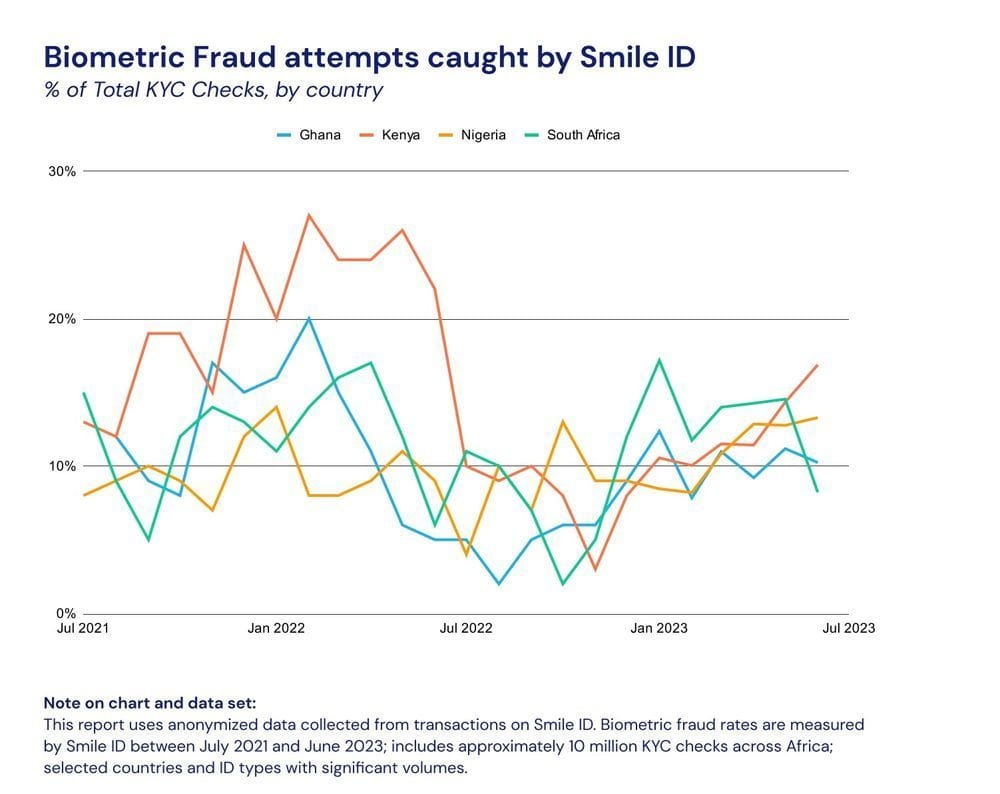

Similarly, in Africa, there is a rise in attempts at identity fraud, particularly in Nigeria and Kenya. Smile ID data reveals that fraud attempts in Kenya increased by 7%, rising from approximately 10% in January to 17% in July 2023. In Nigeria, it went up to 13%, compared to 8% in January 2023. However, Smile ID says “As more businesses across Africa adopt biometrics for identity verification and fraud prevention, more fraud is being caught.”

For startups, like Klasha, who engage in cross-border payments across Africa, this poses a dual challenge, due to increased identity fraud in both the continent and the United States–a key source of remittances to Africa.

According to Wiza Jalakasi, director of Ebanx Africa market development, “From my past experiences, I will advise that you should not even launch your product without fraud mitigations built-in, this is because fraudsters are amongst your first adopters. Fraudsters are on top of everything that is happening in fintech, their common tactic is referral fraud.”

“You are going to start seeing fraud losses from the day you launch your product; and the sooner you can mitigate it, the better,” Jalakasi added.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore