Two days after Payday announced its seed round led by Moniepoint, Weetracker reported that Moniepoint wants to acquire Payday in a cash and equity deal for under $40 million. The acquisition conversations reportedly began during Payday’s seed round fundraising cycle.

However, Moniepoint has denied the news of an acquisition, and Payday has declined to comment. This has dampened any premature celebration of a new exit in Nigeria’s most prominent tech ecosystem, which has already seen an exit in FairMoney’s acquisition of Payforce.

Despite this, the rumoured $40 million acquisition price gives us a sense of Payday’s valuation cap. TechCrunch reported that the lower bound was $15 million, so we estimate Payday’s value to be around $27.5 million.

What is the reason for the secrecy from both parties, and is there any truth to the acquisition rumour?

Let’s dive in and find out.

Five reasons why companies keep potential merger and acquisition news discreet

Proper management of a merger and acquisition (M&A) timing and messaging is necessary to minimise potential negative consequences for both parties involved. Here are five reasons why companies get touchy and defensive about possible acquisition news prematurely getting out:

- Competition and market impact: If news of a potential acquisition is leaked, it can provide competitors with valuable information about the acquiring company’s strategy, potential growth areas, and market position. Competitors may try to sabotage the deal through a counteroffer or other tactics, such as launching a competing product or poaching key talent. For example, both Uber and Lyft expressed interest in acquiring Motivate, a bike-sharing firm. When Axios reported on the story, Uber declined to comment, which is standard practice. It’s best not to speak about a potential acquisition until there is more certainty.

- Regulatory and compliance concerns: Companies do not exist in siloes. A corporate entity is registered under the laws of a particular country or jurisdiction. These business jurisdictions have modalities for assessing potential mergers and acquisitions to prevent malpractices or alleviate anti-trust concerns. Thus, involved parties prefer to move stealthily until there is more clarity on whether a proposed acquisition can occur.In the meantime, internal compliance teams continue to undergo a series of due diligence to clear an M&A transaction. These things take time and can be hindered by public interference if prematurely leaked.

- Internal conflict and trust issues: Finding out in public, for the first time, that your employer, investment, or business partner is considering a sale or acquisition could cause internal conflict or feelings of mistrust amongst involved stakeholders.

- Reputational damage: News of a potential acquisition that doesn’t happen could give the impression that the target company is in trouble or unfit for purchase, making it difficult to attract future investors, customers, and employees.

- Business disruption: Pressure from investors to maximise the M&A transaction could lead to decisions that are not optimised for the long-term interests of the companies. For the target company, it could also lead to changes in employee morale as they worry about their future in the event of an acquisition.

Now you know why both parties are wary about saying much. First, let’s discuss what Moniepoint and Payday stand to gain from a potential acquisition. Before then, let’s examine why Moniepoint might have invested in Payday.

Beyond the headlines, why did Moniepoint invest in Payday?

It is common knowledge that Moniepoint invested in Payday’s seed round. More interesting, they led the round, indicating a high-interest level from Moniepoint in Payday. This is not an everyday occurrence in which an “operating” company invests in the round of another company.

Where have we seen this playbook before? In Stripe and Paystack.

In 2018, Stripe led an $8 million Series A round into Paystack. This was a round with Visa, a player worth over 15x of Stripe. So, if anyone should lead the round, it could easily have been Visa. But they didn’t, and Stripe did.

At the time, Patrick Collison, Stripe’s CEO, said, “We’re excited to back such people in one of the world’s fastest-growing regions.”

This signalled that if a potential acquisition occurs, it would most likely be due to Stripe’s geographic expansion to an emerging market. When the acquisition happened in 2020, TechCrunch noted, “Typically, it (Stripe) has only acquired smaller companies to expand its technology stack, rather than its global footprint.”

Now, let’s examine Moniepoint CEO Tosin Eniolorunda’s comment on their Payday investment. He said, “More important is the alignment in our goal to provide financial happiness by addressing key payment pain points—Moniepoint with merchants and Payday with individuals. We see a potential to leverage their infrastructure further to deepen our suite of financial services for merchants, and we’re looking forward to all that’s to come.”

Thus, if Moniepoint acquires Payday, it’s most likely to extend its offerings or “expand its technology stack”.

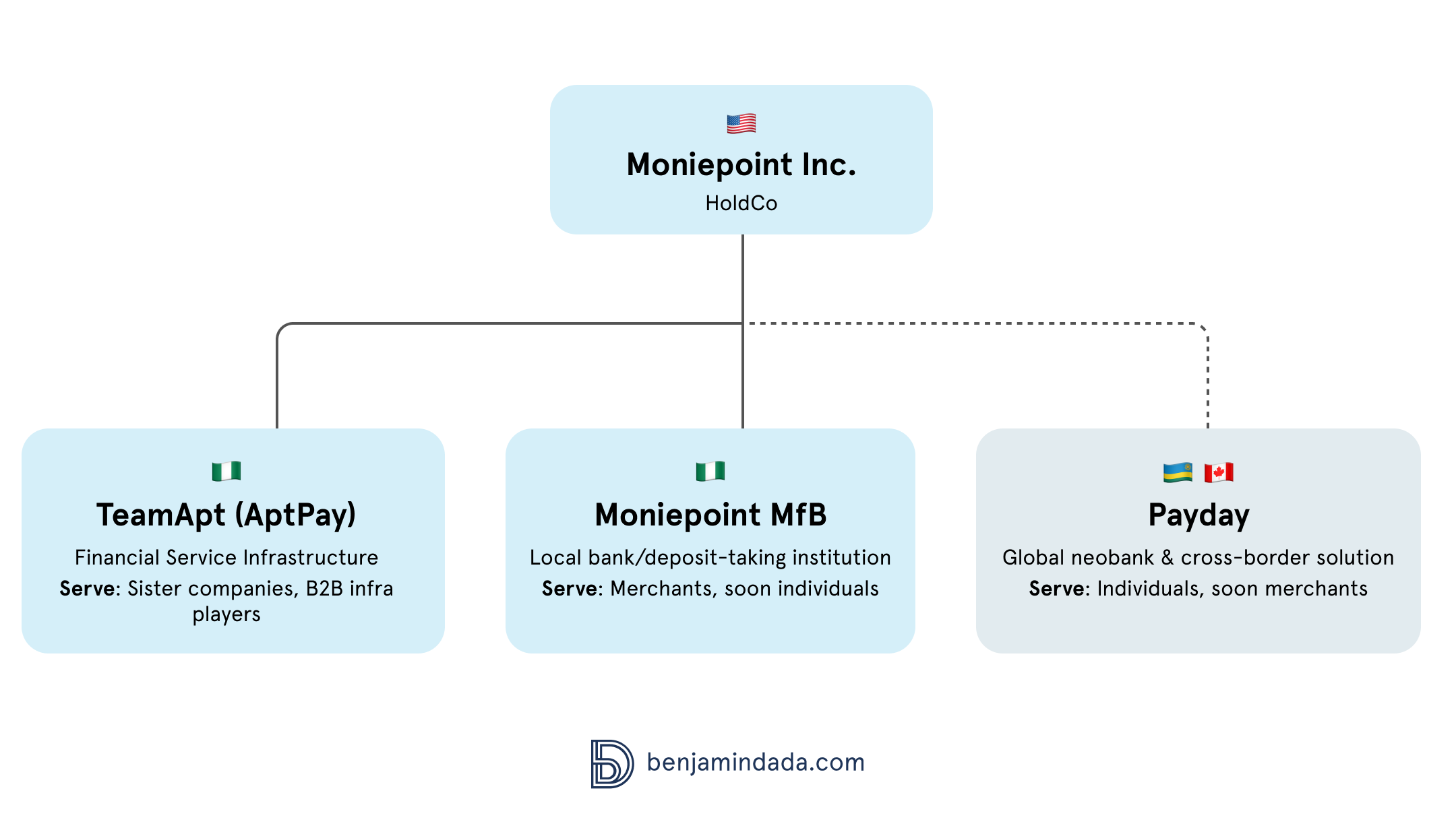

Also, note that I had put operating in quotation marks because Moniepoint Inc. is a holding or parent company. So, technically, they are not the operating company (a subsidiary). So, if they were to acquire Payday, they’d bring it into their family of companies and facilitate the required interoperation needed to offer a holistic service to their customers.

In their denial of Weetracker news, an executive at Moniepoint tells Benjamindada.com that “it (Payday) is a strategic investment…”. The more we think about it, the clearer it becomes.

What are the potential benefits of a possible acquisition of Moniepoint and Payday?

Why would Moniepoint want to acquire Payday?

Moniepoint Inc. services different sets of customers: individuals, merchants and businesses.

With TeamApt, they play an infrastructural role, serving its sister companies and other B2B players via APIs and other white-labelled payment solutions.

With Moniepoint MfB, they’ve built a client-facing business banking solution (PoS machine and software) used by many merchants and SMEs. They could further tap into the retail market by acquiring Payday.

Coupling their acquiring and processing capabilities with Payday’s cards and account issuing capabilities, they could unite to become a full-stack service provider offering foreign virtual cards to their customers, enabling them to spend their money globally. They could also start enabling payment collections and settlement in foreign currency for their merchants. Thereby deepening the ARPU of each merchant customer on their platform.

So, Moniepoint could either build out all these additional foreign exchange and issuing capabilities—which would take at least 18 months to become mainstream—or acquire a smaller company already doing this now.

If they decide on the acquisition route and Payday is no longer a suitable target, they could consider other startups enabling remittance and cross-border transactions in Nigeria.

Potential benefits to Payday on an acquisition by Moniepoint

Payday stands to benefit meaningfully from an acquisition by Moniepoint. Besides returning money to their investors, Payday can leverage TeamApt’s infrastructure, Moniepoint’s networks, and scale to secure the licensing they pursue in their expansion markets.

It is important to note that Payday is a Rwandan company, so to operate in Nigeria, they need a licence or partnership with a licenced player. To launch Cherry Finance, one of their products that became Payday 3.0, they partnered with Flutterwave. However, we’ve noticed that Payday’s main website now displays Moniepoint’s logo, which could result from the new partnership with their lead investor and rumoured acquirer.

If they get acquired by Moniepoint, then they will not need to worry about licences in Nigeria. As a result, they might not actually need to register a company in Nigeria.

Next, their expansion into Canada and the United Kingdom, as stated in their Seed announcement. Although they have registered entities there, per their website, they need licences to operate in the country. Moniepoint or an equally prominent player could help them facilitate that process by drawing on their own investors, business network and financial backing.

According to Weetracker, Moniepoint and Payday have agreed on broad terms to complete the transaction and make it official by the end of Q2 2023.

Whether the acquisition goes through remains to be seen, but I believe it would benefit both parties. However, I do not have any personal interest in the matter, as I’m neither an employee nor an investor in the involved parties.

Payday’s Future: Exit Strategies and the Role of the Founder

Sadly, nine out of ten startups fail. However, Payday, a two-year-old startup, still has room to grow and is under no pressure to exit now. On average, payment startups take four years to exit, which could take even longer in Africa. Nonetheless, Paystack managed to do it in five years.

There are several ways to exit a startup, including an IPO, a merger and acquisition, an acquisition, or an acquihire. These can be summarised into an IPO or a merger and acquisition. Most startup exits from Nigeria have been through acquisitions, such as Paystack to Stripe and Payforce to FairMoney.

The founder is an important factor in how a startup grows, attains profitability, and returns value to investors. Favour, the founder of Payday, is a serial entrepreneur who understands the power of marketing and has the skill set of a senior developer. This helps him get started on ideas quickly and secure media attention.

In March 2020, I exclusively broke the news about College Situation’s exit to ABiT Network. College Situation had only spent three weeks on the app store before ABiT Network acquired it for ₦22 million. After the acquisition, Favour retained his role as the Product Manager for College Situation, an app connecting students to global resources.

His investors love him because of his ruthless execution and work rate.

“I’d bet on Favour and Payday again any day, both to realise the transformational value and also to make us proud with an exit the ecosystem will reference for years to come,” tweets Maya Horgan-Famodu, Founder of Ingressive Capital. Ingressive Capital had invested in Payday as part of its Fund I and made a follow-on investment into the company from Fund II.

Given his antecedents, I do not doubt Favour will be open to an acquisition. As for him, it could most likely be an acquihire, as he is an entrepreneur and a skilled employee.

Nonetheless, Favour needs to improve his transition from a zero-to-one builder to a one-to-scale CEO.