This year, not every headline for the African tech ecosystem reflected a low point. Despite its challenges, the ecosystem displayed resilience and has recorded notable events.

Recently, the Central Bank of Nigeria lifted the two-year-old ban on cryptocurrency transactions. This development has generated excitement, particularly within the country’s crypto and web3 sector.

Similar to the uplifting news of the crypto ban being lifted, we’ve compiled some of the tech headlines that have sparked excitement in the African tech ecosystem, particularly in Nigeria.

Acquisitions

As funding becomes increasingly scarce, more African startups are considering mergers and acquisitions. Critics argue that some deals are essentially fire sales masked as acquisitions.

Per BD Funding Tracker, about 26 acquisitions were announced this year. Nigeria stands out as the primary market for most of these deals, recording nine acquisitions, followed by South Africa with four, and Egypt and Kenya each reporting three. Acquisitions also took place in Uganda, Benin, Ghana and Tunisia.

Additionally, the fintech sector recorded the highest number of deals this year, followed by mobility, Web3 and crypto, and e-commerce. Other sectors involved in acquisition deals include artificial intelligence, gaming, healthtech, cleantech, identity, insurtech, proptech, and communications.

Instadeep x BioNTech: 2023’s mega acquisition

In January, German-based biotech company, BioNTech acquired InstaDeep, a Tunisian AI startup for $680 million. The transaction involved an upfront payment of cash, unspecified BioNTech shares worth £362 million, and a balance of £200 million payable based on InstaDeep’s future performance.

Read More: We tracked over 26 African tech acquisitions in 2023

Other notable acquisitions that drove conversations this year are the acquisition of Tunisian gaming startup, Galactech by Egyptian e-sports platform GBarena in a $15 million share swap deal and Ugandan mobility fintech, Asaak’s acquisition of FlexClub.

A tech bro at the helm of policy in Nigeria

Shortly after assuming office, Nigerian President Bola Tinubu nominated ‘Bosun Tijani, the co-founder and then CEO of CcHUB, for a ministerial role. Within two weeks of his designation as a minister, Tijani was appointed as Nigeria’s minister of communications, innovation, and digital economy.

Due to his instrumental role in fostering the growth of the Nigerian (and African) tech ecosystem, Tijani’s appointment generated considerable excitement among tech entrepreneurs who anticipated his effective representation of their interests.

Since assuming office, the minister has undertaken numerous initiatives that have been well-received by the ecosystem. These include the initiative to train three million technical talents and the ongoing formulation of an AI policy, among other commendable efforts.

Flutterwave free of fraud allegations in Kenya

In our retrospective analysis of the ecosystem’s challenges last year, Flutterwave’s encounters with regulatory and legal obstacles ranked among the top six. The Kenyan Asset Recovery Agency accused the company of money laundering, and the Central Bank of Kenya asserted that it operated without a license.

However, in November, the fintech startup successfully cleared all money laundering charges, leading to the release of some of its frozen accounts. Flutterwave is also progressing with its license application.

Flutterwave is planning to invest $50 million in Kenya as part of its expansion into the Kenyan market. Outside Kenya, the fintech startup embarked on a licence acquisition spree this year, it also expanded into other markets including India.

Techstars in Lagos

In April 2022, Techstars, one of the most active investors on the continent, inaugurated the Techstars Accelerator Program based in Lagos in collaboration with ARM Labs Lagos. Subsequently, in January, the accelerator made investments in 12 African startups, among them being alphabloQ, peppa.io, CDCare, and Keza Africa.

A few weeks ago, the accelerator announced investments into 12 other African startups for its second cohort.

Techstars’ current portfolio sees Africa making up around 40% of its overall investments. With an outpost in Lagos, the global accelerator has strengthened its focus on investing in the continent.

VC funds for Northern Nigeria

While Nigeria stands out as a primary destination for tech venture capital funds in Africa, the majority of investments are concentrated in Lagos and other states within the southwest region.

In November, Abuja-based VC firm, Aduna Capital launched a $20 million fund to back tech startups in Northern Nigeria.

According to Surayyah Ahmad, founding partner at Aduna Capital, “Northern Nigeria is often misunderstood and misrepresented, and over time this has led to stereotypes that have made it difficult for startups from northern Nigeria to secure funding, even when they have promising ideas and strong teams.”

Earlier this month, former governor of Kaduna state, Nasir El-Rufai announced his plan to launch a $100 million fund to invest in Nigerian startups, especially those in the North.

The deployment of both funds will improve investment in the region and also drive innovation.

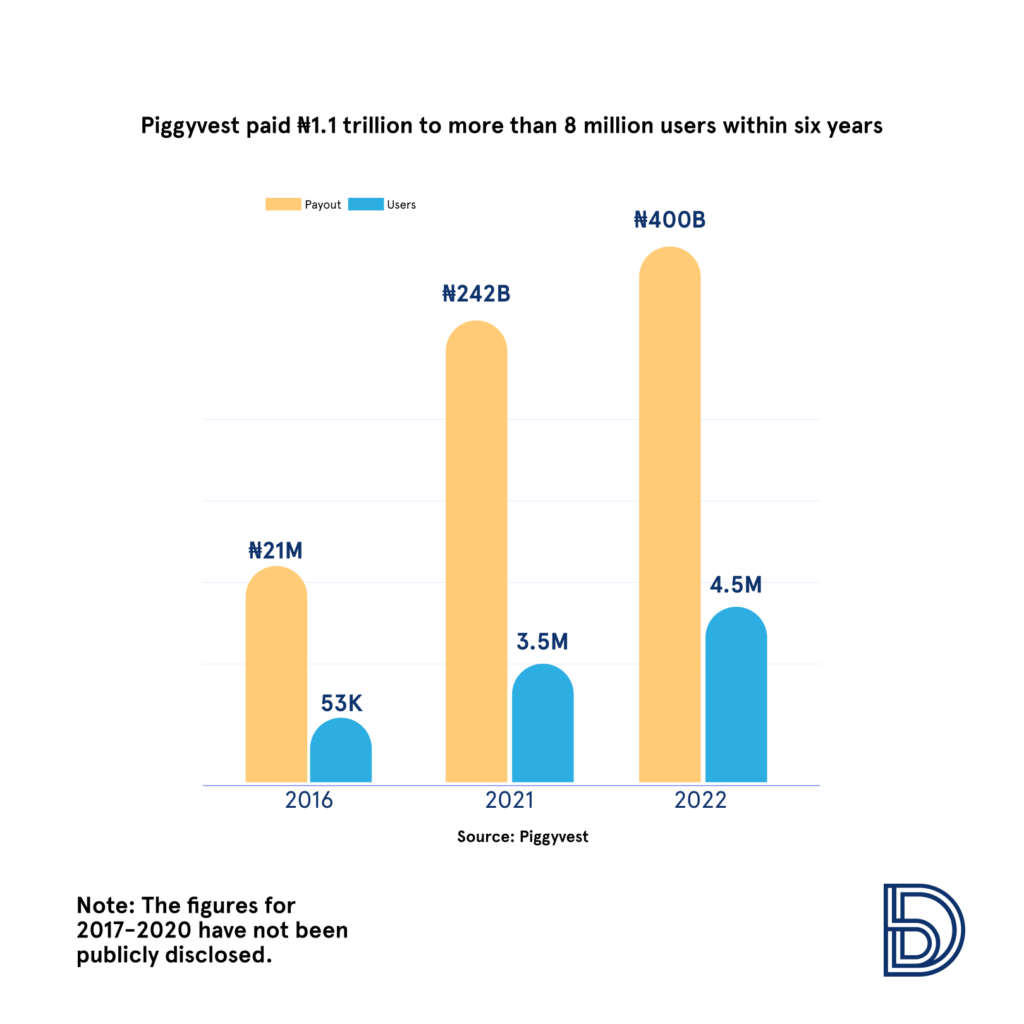

Piggyvest’s ₦1.1 trillion payouts within six years

In September, Odun Eweniyi, co-founder and COO of Piggyvest disclosed that the Nigerian wealth management startup disbursed approximately ₦400 billion to its users in 2022, resulting in a cumulative payout of over ₦1.1 trillion since its inception.

This underscored the thriving savings culture in Nigeria, as indicated by the PiggyVest Savings Report 2023.

It’s important to note that this does not represent the total amount of money saved by users. “Our disbursement model means that this amount is money that people saved and requested. Only a few people withdraw their money. It represents the liquidity we had to return their money,” says Josh Chibueze, PiggyVest’s co-founder and CMO.

₦1 billion GMV at Chowdeck

Another figure that stirred discussions within the ecosystem this year was Chowdeck’s. In November, the YC-backed food delivery startup revealed a monthly gross merchandise value (GMV) of ₦1 billion ($1.2 million). Chowdeck operates with approximately 1,300 riders across the four Nigerian cities.

Recently, the startup added Shoprite to its list of grocery chain partners, allowing shoppers in Lagos, Ibadan, Abuja, and Port-Harcourt to make purchases from Shoprite through the platform. This move has the potential to enhance its GMV in the coming year.

Despite the challenging market conditions that led to the exit of food delivery startups like Bolt Foods, many users are hopeful that the startup can thrive while competing with established players such as Glovo.

The Tech Nation comeback

Six months after it ceased operations, Tech Nation, a UK organisation that endorses Global Talent Visa, relaunched its operations in October.

Nigeria is the African country with the most applicants for the UK Global Tech Talent Visa—which Tech Nation provides endorsement for. The West African country ranks third in the world with 11.3% of applications globally.

The shutdown initially brought disappointment to numerous prospective applicants, but the reopening has instilled hope in many young Nigerians actively saving and planning for migration.

Safaricom M-PESA’s Ethiopian expansion

Following its expansion into Ethiopia last year, Safaricom obtained a mobile money licence from the National Bank of Ethiopia to extend M-Pesa services in the country. This license positions the telco in direct competition with the state-owned mobile money provider, telebirr, which previously held a monopoly.

The inauguration of Norrsken House Kigali

In Rwanda, the Norrsken Foundation inaugurated Norrsken House Kigali, a 12,000-square-meter campus aimed at fostering innovation in the country and across the continent. Local reports indicate that the hub is already accommodating more than 1,200 local and foreign startups.

Additional noteworthy headlines encompass the release of “Vantage,” a memoir authored by Olumide Soyombo, co-founder of Bluechip Technologies and founder of Voltron Capital. Furthermore, there was a reversal of the shareholding rule mandating Big Tech companies to sell 30% of their shares to Kenyan locals.

Starlink also marked a significant milestone by commencing its inaugural African operations this year in Nigeria. The satellite internet provider is now operational in at least nine African countries.

Editor’s Note: This is not an exhaustive list.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore