Following its inability to raise additional funding, Nigerian crypto payment gateway, Fluidcoins sold a 100% stake to UAE-based Nigerian-led Blockfinex.

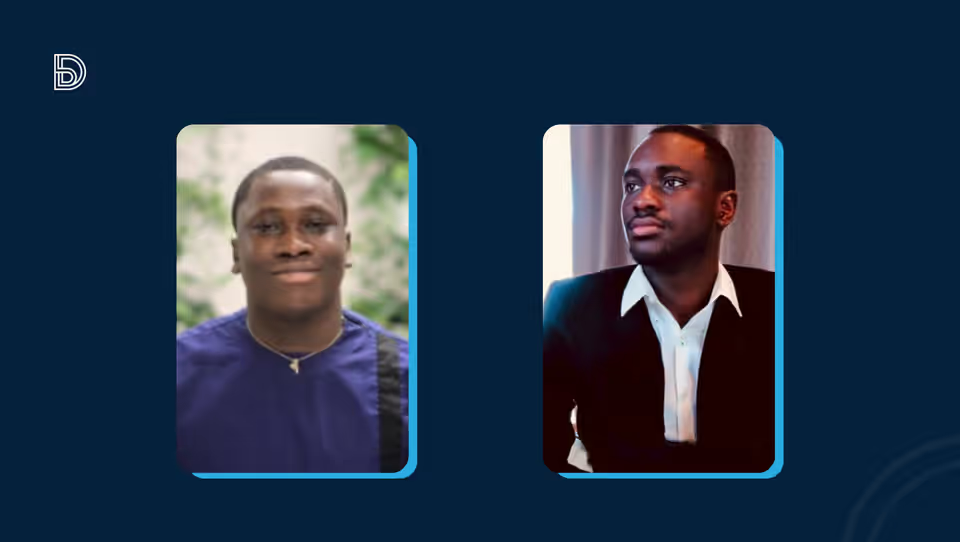

The undisclosed deal is an acqui-hiring—this means that the founding team of Fluidcoins will still work on the product. “There will be no management or staff changes,” Danny Oyekan, the founder and CEO of Blockfinex, said.

This is arguably the first acquisition in the Nigerian crypto ecosystem. The deal was facilitated by Dan Holdings Limited, a web3 ecosystem and venture fund, and the parent company of Blockfinex.

With this acquisition, Oyekan said that Blockfinex will use Fluidcoins Wallet-as-a-service product to reach more than 600 cryptocurrencies and will also expand Fluidcoins Checkout businesses to serve more businesses across.

The company also intends to use the acquisition to launch a new product, BlockPay, which will be available in the UAE, the US and Africa. According to Blockfinex, BlockPay will be a payment processor and API wallet-as-a-service provider. It will also continue to facilitate payments for Fluidcoins existing clients like Accrue, The Peer, and GetEquity.

“We intend to provide these services to Digital Banks and Payments services around the world. Providing them access to use Blockfinex’s liquidity to offer over 600 cryptocurrencies available on Blockfinex and 2000+ trading pairs,” Oyekan said in a LinkedIn post. “Flip By Fluidcoins will also serve as an onramp and off-ramp for Fiat into Crypto. And we will work towards offering cryptocurrencies like Bitcoin, Ethereum, Aptos, Cardano, Mina Protocol, Solana and many more on Flip in the near future.”

Inside Fluidcoins cash deficit and a “fire sale” option

Launched by Lanre Adenowo in 2021, Fluidcoins is building a crypto infrastructure for businesses providing them with the tools to participate in the DeFi economy, and helping these businesses to accept online and offline stable-coin payments and international payments. The company lists ThePeer, Accrue, GetEquity and Orchestrate as some of its clients.

Since its launch, the Nigeria-based company raised about $150,000 from two syndicates, ten angel investors and one crowdfunding organisation.

With the global economic downturn, Fluidcoins was unable to raise follow-on investments after securing the aforementioned capital. “We have a balance sheet deficit on Flip for ~$30K…[we are] unable to raise extra cash hence requiring us to either shut down or make a fire sale—went with this option. Shutting down wouldn’t cover item 2,” according to a statement by Fluidcoins.

However, the decision to sell Fluidcoins was allegedly down without the knowledge its existing investors. TechCabal reports that these investors will not get returns on their investments describing it as “one of the highlighted risks in venture capital investing”.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore