The surge of API fintech companies in Africa has been tremendous over the years, with Mono, Okra, OnePipe, Pngme, Bloc, and Stitch securing investments to strengthen their objectives.

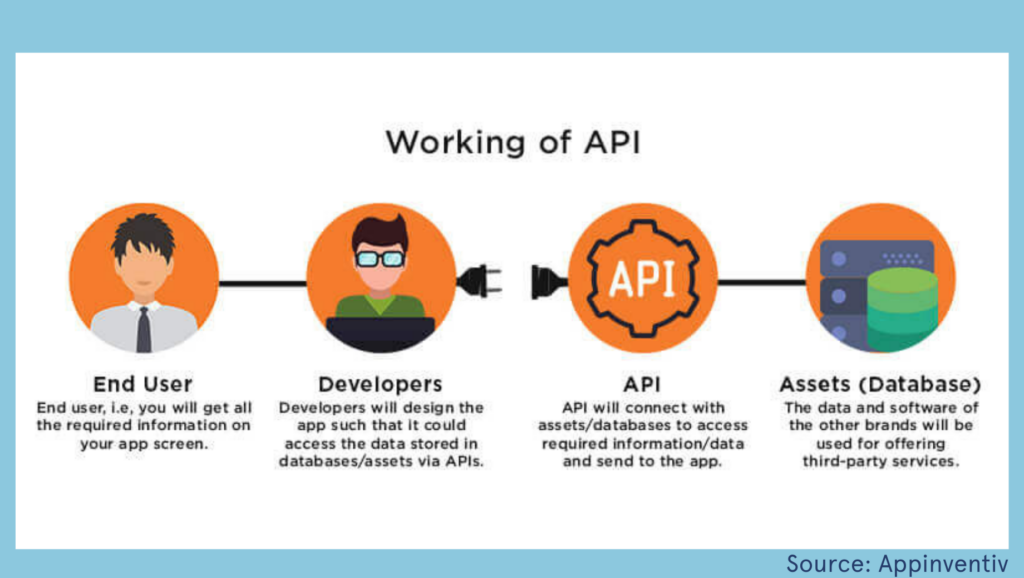

Underlying every transaction you make on a ride-hailing or e-commerce platform, bank or fintech app, there are interactions enabling you and billions of consumers that use these services; these interactions are referred to as application programming interface (API).

An API is a set of functions that allows applications to access data and interact with external software components, operating systems, or microservices.

I’m curious as to what non-technical people think when they hear the term “API”.

— Mayowa George (@Wana____) December 30, 2021

Understanding how APIs works

Think of an API as the mechanical process that goes inside the door’s lock when you’re trying to access a locked room. In fintech, it enables parties involved in financial transactions, including banks, websites, consumers and third-party providers.

Since API fintech companies are playing an important role in the advent of open banking, it will not be out of place to say that these companies will enable the continent to achieve financial inclusion.

Open Banking has the ability to drive accessibility to financial services and much more personalized and cost-effective products for all types of customers by providing access to transaction data.

For Bloc, Praise Philemon, the Communications Lead said “every company will be a fintech company, hence, Bloc is working to ensure consumers get access to financial solutions with minimal hassle such as enabling agency banking to rural communities within Africa”.

The benefits of fintech API include:

- Automation enables development and accelerated time to market

- Significantly reduced development costs

- Data security

- More time and resources to focus on innovation instead of repetitive development tasks

After speaking with over 50 Nigerian fintech companies, the Stitch team saw an overwhelming need for a more seamless and affordable payments solution. Nigeria-born innovators like Paystack and Flutterwave have pioneered online payments acceptance, but there is a significant opportunity to optimize the experience for businesses and users.

Challenges API fintech companies in Africa face

One of the challenges these companies face, the Country Manager – Nigeria of Stitch Benjamin Dada said, is “Lack of technology or framework for building out API structures. Another challenge is, little developing skillset, a few people are experienced in developing these infrastructures”.

He added that consumer education and security are also bottlenecks for API fintechs, “With APIs, you need to ensure that the partner you are working with has enabled a secure way to communicate information, from data storage to encryption protocols”, Benjamin said.

Venture funding in Africa’s API fintech sector

Last year, API fintech companies witness a number of venture funding. Pngme raised $15 million and Mono secured $500,000 pre-seed to power its innovative API that allows organizations to generate bank statements, verify account details, initiate payments, and perform credit checks.

Okra also raised $3.5 million in a seed round. In South Africa, Stitch secured a $2 million seed extension — bringing their total seed funding to $6 million. OnePipe raised a $3.5 million seed to meet the rising demand for embedded finance on the continent.

This venture capital flow reflects the immense potentials within the ecosystem. There are about 15,000 APIs globally, with 40 new ones created every week. Compared to the fewer than 400 public APIs available in 2006. Salesforce generates 50% of its revenues via APIs, eBay generates 60%, and Expedia 90%.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore