Although most of the funding for African startups comes from foreign venture capital firms, indigenous firms are also actively investing in these startups. Africa-based investors comprised 25% of the total number of investors [PDF] active in Africa’s VC landscape in 2021.

Previously, we curated a list of Nigeria-based and Silicon valley-based and their portfolio companies, in this listicle, I spotlighted publicly disclosed cheque sizes of some African-focused firms. Other prominent venture capital firms like Future Africa were omitted from this list because their cheque sizes are not publicly available.

Ingressive Capital

Founded by Maya Horgan Famodu, Ingressive Capital targets 10% ownership in Pre-Seed to Seed tech-enabled companies based in sub-Saharan Africa or Egypt with typical cheque sizes of up to $400,000.

Ingressive Capital made 4 new investments—Grey, PayDay Africa, Mecho Autotech and Complete Farmer—and 6 follow-on investments in Carry1st, Mono, OnePipe, Bamboo, 54gene and Seamless HR.

In March, 776’s founder Alexis Ohanian—who also co-founded Reddit, and partner at Y Combinator—announced Ingressive Capital as the first African recipient of the Titan Fund, receiving $500,000 initial investment from 776, as well as access to 776’s proprietary operating system, Cerebro.

Microtraction

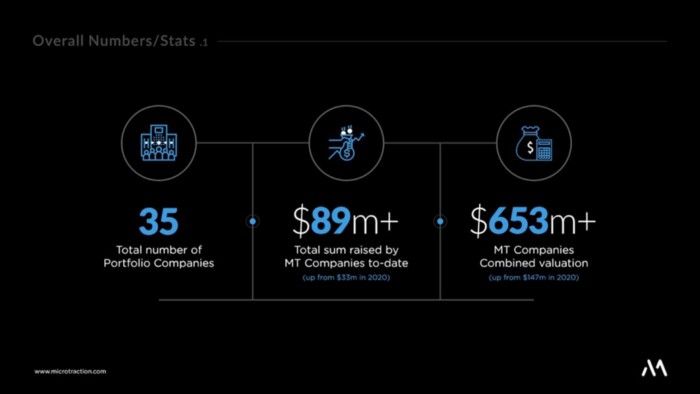

Microtraction is an early-stage venture capital firm based in Lagos. The firm recently reviewed its standard deal to a minimum of $100,000 for 7% equity on a post-money SAFE. Microtraction also gives an option for a quick top-up in their portfolio’s next round of up to $350k as long as they are not more than 25% of the round and meet specific milestones.

In 2017, Microtraction had a standard deal of $15,000 for 7.5% equity in startups. However, it was reviewed to $25,000 for 7% equity in 2020. The firm invested in 13 companies—Orda, InstantRad, Bumpa, HoneyCoin, Pivo & 8 unannounced—in 2021, totalling its portfolio to 35 companies.

Ventures Platform

Ventures Platform invests in Pre-Seed to Series A. Even though they typically invest across all sectors, the firm is focused on startups in financial services and insurance, life science and health tech, edtech and digital talent accelerators, enterprise SaaS, digital infrastructure plays, agritech and food security.

Previously, Ventures Platform invested an average cheque size of $50,000 in pre-seed and seed startups. However, the firm raised a $40 million pan-African fund, following the raise TechCrunch reported that the firm will participate in Series A deals where it will be able to invest more than $1 million in a single company (including follow-on rounds).

4DX Ventures

Launched in 2014, 4DX Ventures is a pan-Africa focused venture capital firm. The firm writes cheques of about “a few $100,000 to a few million” across all stages (pre-seed to Series B) usually for startups in Africa’s Big Four markets—Nigeria, South Africa, Egypt and Kenya.

However, the firm is now investing in other countries, especially in the Francophone region; including a recent investment in Côte d’Ivoire’s Cinetpay. 4DX Ventures completed the final close of its second fund at $60 million last December.

Lateral Frontiers VC

Lateral Frontiers VC is a mission-driven venture fund investing in and advising early-stage opportunities in Sub-Saharan Africa. The firm focuses on Seed to Series A fund and often writes cheques between $250,000 to $5 million.

Ajim Capital

Ajim Capital is an early-stage fund and angel community that provides startups in Africa with financing from Pre-seed to Seed with typical cheque sizes of $100,000 to $250,000. Ajim has invested in several African startups including Mono, Bamboo, Talent QL, and Lemonade Finance. In January, Ajim Capital launched a $10 million fund to invest in African tech startups.

FirstCheck Africa

FirstCheck Africa, is a female-focused African venture capital firm that is “fixing capital access for female tech entrepreneurs in Africa needs an intentional, female-led approach.”

Founded by Eloho Omame and Odunayo Eweniyi, FirstCheck provides female-led startups with cheque sizes between $15,000 to $25,000

Voltron Capital

Voltron Capital is a pan-African pre-seed and seed-focused venture capital firm. Its cheque sizes range from $20,000 to $100,000, focusing on startups in Nigeria, Kenya, South Africa and North Africa. So far, the firm has invested in Spleet, Trove, Brass, Piggyvest, Mono and other notable African startups.

DFS Labs

DFS is a VC firm that invests in digital commerce companies serving African markets. The firm usually invests in pre-seed rounds with a $25,000 cheque into a post-money YC SAFE with a standard valuation cap.

After the pre-seed round, DFS Labs works with its portfolio companies for four to six months on a growth plan that leads to the company’s next round of financing.

Kepple Africa Ventures

Kepple Africa Ventures is bridging the gap between seed and Series Avin Africa because investors are usually fragmented. Typically, Kepple provides a cheque size between $50,000 and $150,000.

GreenHouse Capital

GreenHouse Capital is a fintech investment company in Africa. Founded in 2014, the firm has made over 25 across 15 countries, its cheque size is $500,000.

Oui Capital

Founded by Olu Oyinsan and Francesco Andreoli, the firm launched its first $10 million fund in 2018. The investment firm aims to bridge the gap between high-growth technology startups in sub-Saharan Africa and the first “yes” (Oui means yes in French) founders get as they embark on their journey to build tech-enabled businesses for the African market.

After investing in 18 tech startups across seven African countries, Oui Capital recently launched a $30 million second fund—Oui Capital Mentors Fund II to invest in 30 early-stage startups.

With the Oui Capital Mentors Fund II, the firm will now write cheques of about $750,000 (a 10x increase from the ticket size of its first fund) with reserves in place for such follow-on investments.

A summary of the cheque sizes of African VC firms

| VC firm | Cheque size | Funding round | Equity |

|---|---|---|---|

| Ingressive Capital | $400,000 | pre-Seed and Seed | 10% |

| Microtraction | $100,000 | early-stage | 7% (post-money SAFE) |

| Ventures Platform | $50,000 | pre-Seed and Seed | Undisclosed |

| 4DX Ventures | $100,000 | pre-Seed to Series B | Undisclosed |

| Lateral Frontiers | $250,000 to $5 million | Seed to Series A | Undisclosed |

| Ajim Capital | $100,000 to $250,000 | pre-Seed and Seed | Undisclosed |

| FirstCheck Africa | $15,000 to $250,000 | pre-Seed and Seed | Undisclosed |

| Voltron Capital | $20,000 to $100,000 | pre-Seed and Seed | Undisclosed |

| DFS Labs | $25,000 | pre-Seed | Undisclosed |

| Kepple Africa Ventures | $50,000 to $150,000 | pre-Seed and Seed | Undisclosed |

| GreenHouse Capital | $500,000 | pre-Seed to Series A | |

| Oui Capital | $750,000 | pre-Seed to Series A |

Editor’s Note:

- This list will be updated once we get details of the check sizes of other firms.

- 28 June, 2022: GreenHouse Capital was added to the list.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore