On November 17, there was an uproar on “FinTech Twitter” that arose from the tweet of Onyeka Akumah, the CEO of Farmcrowdy—an agritech startup.

The poster citing the Central Bank of Nigeria (CBN) read: “FinTech startups must now have a capital requirement of ₦5 Billion before they get their licences”. At the bottom of the poster, it directed people to the BusinessDay site “for a full perspective” (which signals to me that the poster was intended to be a clickbait).

Do we mean that a Fintech ‘Startup’ in Nigeria should first have $13m USD before they get their license? A startup??? pic.twitter.com/MHUuIh7h5t

— Onyeka Akumah (@onyekaakumah) November 17, 2018

However, like most things on Twitter, we read only the headlines and run with it, without regarding the “full perspective”.

For starters, the figure “₦5 billion” is one fintech stakeholders are all too familiar with, as it could represent the monetary value associated with any of these three financial services license regulations:

- Payment Service Bank (PSB)

- Super licence, Payment System Provider (PSP) and

- National licence, Microfinance bank (MfB)

So, it’s imaginable that observers can mix them up when the phrase “₦5 billion” is being mentioned in relation to financial services with no additional context. This kind of mix up was precisely the case with BusinessInsiderByPulse’s (BIbP) rebuttal of the misleading BusinessDay poster, where BIbP assumed that BusinessDay’s report was referring to the PSB license requirement. As a result, their article focused on explaining what a PSB is and what it is not.

“Over the weekend, there was a misleading report that financial technology companies (Fintechs) will have to pay ₦5 billion for licencing as a payment service provider in Nigeria. This report is absolutely false as a Payment Service Bank (PSB) framework is totally different from a payment service provider…”, Business Insider by Pulse wrote.

At first, I also thought that the BusinessDay poster was referring to the PSB license that surfaced on October 5, 2018, but after reading the BusinessDay piece, I ascertained that they were not referring to that.

Wait. I thought this was only for those that wanted to get a PSB. @BusinessDayNg ♂️ pic.twitter.com/DtWFH2dKKw

— Benjamin Dada (@DadaBen_) November 18, 2018

So what was BusinessDay referring to?

They were referring to the circular on the new CBN PSP licensing regime (license tiering) that required intending acquirers of a Payment System Provider Super licence to have a minimum shareholders fund (SHF) of ₦5 billion.

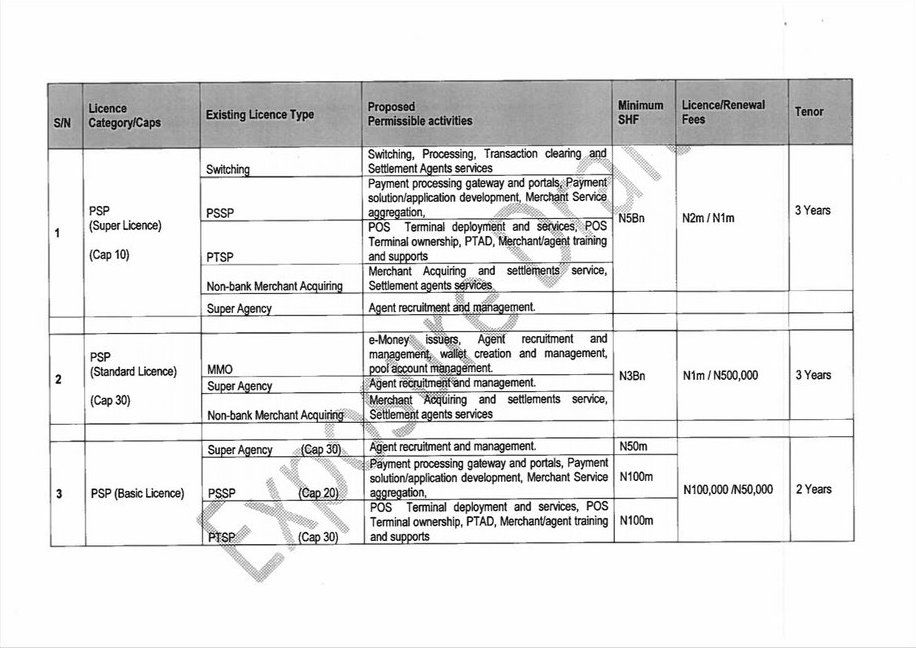

This circular dated October 15, categorised the licensing packages for intending and existing payment system providers into three:

- Basic licence

- Standard licence

- Super licence

Each with their corresponding minimum SHF, licensing or renewal fees and Tenor.

From fragmentation to the consolidation of financial services licence

Before now, to operate in the Nigerian financial services space, one had to acquire either of these six fragmented—sometimes mutually exclusive—licences. They are Mobile Money Operator (MMO), Payment Solution Service Provider (PSSP), Agency banking, Switching, Payment Terminal Service Provider (PTSP) and Microfinance bank.

- MMO: typically for wallet-based services and e-money operators like Paga

- PSSP: typically for fintechs looking to drive collections like Paystack and Flutterwave

- Agency banking: typically for those looking to run and operate agency banking models like Paga Agents and QuickTeller paypoints

- Switching: typically for transactions processing and settling companies like Interswitch and NIBSS

- PTSP: typically for running hardware financial touchpoints like POS and ATM. Unified Payment Services Limited—a 21-year-old payments processing company (older than Interswitch) has this license.

Now, with the new licensing regime, holders of a standard licence can operate as an MMO, and holders of a basic licence can operate as a PSSP.

Good to know: QuickTeller paypoint (agent network) is the trading name for Interswitch Financial Inclusion Services (IFIS) Limited

All the licensing tiers can recruit and manage agents.

When it comes to financial inclusion for the rural and very remote parts of Nigeria, human aides (AKA agents) are crucial due to the high levels of illiteracy and dependent population (aged) that makes it difficult for residents to carry out financial transactions themselves.

Take for instance, Paga—the top mobile money operator in Nigeria—has 10 million plus users, thanks in large parts, to her vast network of over 15,000 (more than the number of bank branches and ATMs in the country) paypoints (agents).

Therefore, the CBN judges agency banking as one of the ways to achieve their financial inclusion goal. As a result, they have thrown in agency approval into the three licencing tiers to propel licence holders to implement agent networks.

Amongst other things, the super licence PSP holder can serve as a switch but not offer wallet-based services as in the case of MMOs.

Some stakeholders believe this makes no sense as being able to offer wallet-based services (like MMOs) improves the value proposition for owning a Super Licence. Conservatives like the CBN fear that there might be a case of unfair business practice where the Switching company (now a super licence PSP holder) favours his wallet-based service to the detriment of other e-money issuers using their platform for transactions processing.

I stand with the CBN on this one. However, we are not going to pretend like Switches don’t end up creating subsidiaries or acquiring subsidiaries that ride on their switching infrastructure. As in the case of Interswitch and Quickteller. What I would expect from a CBN serious about preventing anti-competitive practices is more oversight and close monitoring of the performance of these Switches with subsidiaries, which I believe is what the apex bank is currently doing.

Per the PSB, the play is this; Telcos can apply to be “promoters” (own a license) via a subsidiary, MMOs can upgrade to PSB, Banking agents and retail chains can also be promoters of the Payment Service Bank.

A report by Pulse shows how Telcos are the most likely to gain from this as a lot of Fintechs (MMOs) might not be able to afford the licensing fee or front the required shareholders capital. While the Telcos already have an incentive to reach the remotest parts of the country with their network coverage, having a parallel goal to deepen their value proposition by offering mobile money solutions targeted at these rural areas seems like a good move for them.

Here is what I imagine would happen, a Telco as big as MTN (owning 39% of the market) would acquire an MMO, push for it to upgrade to a PSB and then use it to drive their core telecoms business.

There are a plethora of articles, hot-takes and explainers that talk about what PSBs can or cannot do, so I would not belabour you with it. However, what you should know is that about 23 organisations are already in the process of registering for the PSB license, I know this because they are undergoing company registrations as “Payment Service Banks”. These companies include Telcos like MTN and Airtel, Paga (an MMO), Verve (a Card issuer), Interswitch, Quickteller and its agency company—IFIS.

My advice to eligible companies (especially FinTechs) currently considering registering as a PSB is to delay. And to spend that time to debate internally on what their core proposition is and how the PSB can strengthen it. Of course, being announced as a newly registered PSB would put you in the news, and observers would probable see you as a forward-thinking company. However, failing at it would be catastrophic and would do a lot of damage to the brand’s reputation.

From all indications (the new PSB regulation and PSP licensing regime), the country’s monetary authority appears to be serious about their “80% financial inclusion by 2020” goal. All that is left is to see how these new regulations help move the needle towards an improved financial inclusion in Nigeria.

Get passive updates on African tech & startups

View and choose the stories to interact with on our WhatsApp Channel

Explore